China is on the rise as a center for pharmaceutical R&D, but companies are still getting their footing for operating in China and the services industry has some maturing to do.

China is on the rise as a center for pharmaceutical R&D, but companies are still getting their footing for operating in China and the services industry has some maturing to do.

The creation in the Paris Region of a multidisciplinary Institute of Technology will bring together the best researchers in world, innovative SMEs and the research centres of large industrial groups.

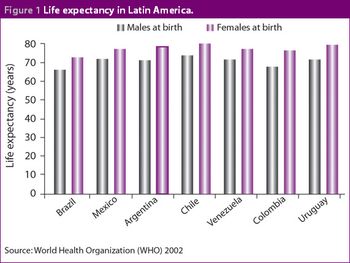

Although it has recently been surpassed by Mexico in terms of value, the Brazilian pharmaceutical market remains of key importance to companies establishing themselves in Latin America. The Brazilian government has focused heavily on improving the healthcare system and this should lead to long-term benefits for its citizens. The Ministry of Health has also attempted to decentralize the management of the healthcare system to more regional and local levels. This has been necessary to account for the different healthcare priorities in different parts of the country.

One of the biggest barriers research and academic institutions face is the ability to get discoveries made in the lab into clinical testing. Because only small amounts of drugs are used in these early studies, they represent fewer potential risks for people in these trials.

The laboratory supplier landscape is undergoing a radical makeover.

The biggest single recent trend in outsourcing solid-dosage processing has been the movement toward discovery and synthesis of more potent active pharmaceutical ingredients.

Research and Markets (Dublin, Ireland) has released ?Annual Investment Analysis Report of the Chinese Pharmaceutical Logistics Industry, 2005-2006.? The report provides analysis of the pharmaceutical logistics characteristics, conditions, pharmaceutical market and pharmaceutical retail dynamics.

Buyers strategically target chemistry, manufacturing, and controls development services.

Indian suppliers of active pharmaceutical ingredients and dosage formulations expand in India, the United States, and Europe.

Recent deals suggest companies are willing to pay up to get into CMC services.

Facing still-sluggish market conditions and a changing world order in fine chemicals, the large Western custom manufacturers are responding by building their toolboxes in specialized technologies in chiral chemistry, catalysis, and biosciences and by adjusting their manufacturing networks via streamlining or investment in Asia.

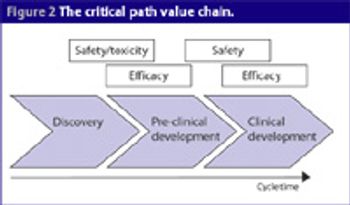

Pharmaceutical companies are seeing the development process in a new way, and that has major implications for service providers.

Cambrex Reports Loss; Advances Biosciences Business

CMOs face market realities and exit some businesses.

Latin America has become a promising region for the pharmaceutical industry in terms of both R&D and sales. Nowhere has this been more apparent than in Mexico, which has become a top priority market for many of the major multinational pharmaceutical companies. Furthermore, the Mexican government is increasing its investment in healthcare resources and there is a strong, growing demand from the population for access to newer and better medical treatments.

Is the lack of finance necessarily spelling doom for the European biotech industry?

The big question for pharmaceutical services providers coming into 2006 is: will the good times continue to roll?

CROs and CMOs are pursuing new strategies to win a larger share of the burgeoning early development pipeline.

OTC Eye-Drop Maker Signs Consent Decree

Pfizer to Shut Parsippany Plant

Contract services providers gained a valuable look into major market conditions, offshoring trends, and 2006 growth opportunities during a morning presentation entitled "CMC Sourcing in transition: Consolidation, Offshoring, and the Market Outlook," presented by Jim Miller. Miller is president of PharmSource (Springfield, VA, www.pharmsource.com), publisher of the Bio/Pharmaceutical Outsourcing , and contributing editor of Pharmaceutical Technology.

Roche Puts Hold on Tamiflu in US

Novartis Purchases Chiron in a Total Buyout

As major pharmaceutical companies take initial steps to prune their supplier base and negotiate better pricing, nonpharmaceutical companies that took those measures 10 years ago are moving to next-generation sourcing strategies. In designing those plans, these front-runners are applying two key lessons learned in recent years: supplier consolidation often doesn't go far enough, whereas price cutting can go too far.

Patheon, CEPH Begin Corrective Action Program for Omnicef OP