- Pharmaceutical Technology-10-02-2014

- Volume 38

- Issue 10

Marrying Big Data with Personalized Medicine

Data analytic strategies can help companies capitalize on personalized medicine.

Global healthcare systems are currently undergoing major transformations spurred by increasing regulation, record public debt, and shrinking budgets. The United States has the dubious distinction of leading the way in this regard. The mandates of the Affordable Care Act, along with shrinking reimbursement to providers, are fundamentally changing the operation of the US healthcare system. At the same time, patients are being challenged to assume greater accountability for their own health, and the industry is moving to a model that better aligns stakeholder incentives to deliver on cost and quality. Healthcare providers and payers that have historically been siloed and fragmented are now exploring ways to collaborate and coordinate efforts to reduce costs while improving patient safety and healthcare quality.

Amidst lower reimbursement from payers and declining productivity in R&D, manufacturers are looking to develop high-value, cost effective and targeted drugs. It has long been maintained that personalized medicine offers the prospect of improved health, better outcomes, and less harm. It should not be surprising that the concept of personalized medicine has become a buzzword throughout the industry as manufacturers increasingly see it as the solution to many of their business needs. In fact, the number of personalized medicine products has more than quadrupled in recent years, from only 13 on the market in 2006 to more than 70 in 2012, and a recent report projects that the US market for predictive personalized drugs will double, increasing from $9.2 billion in 2013 to $18.2 billion in 2019 (1).

FDA defines personalized medicine as “the tailoring of medical treatment to the individual characteristics, needs, and preferences of a patient during all stages of care, including prevention, diagnosis, treatment, and follow-up” (2). Other definitions include specific language around using biological information and biomarkers on the level of molecular disease pathways, genetics, proteomics as well as metabolomics to stratify patients. Some examples of personalized therapies, devices, or technologies that illustrate the broad nature of the term include an implanted 3D-printed tracheal splint, an artificial pancreas device system, drugs aimed at molecular targets specific to a patient’s disease state (e.g., Kadydeco for cystic fibrosis and Zykadia for melanoma), immunotherapies that combat tumors using the body’s own immune system, and disease risk assessment through genetic testing.

Regardless of how the term is defined, one thing is clear--data and analytics have emerged at the center of this patient-centered and personalized ideal. Technologies that can extract large amounts of data from samples or biopsies are allowing for previously unknown factors involved in disease to be identified and used as drug targets or disease biomarkers. “Big data can help us personalize medicine, and also glean new insights from big numbers of patients in the real world like never before,” according to Geno Germano, head of Pfizer’s Global Innovative Pharma division (3). Many stakeholders including manufacturers, however, are still struggling with how to effectively leverage massive data sets to improve efficiencies, reduce costs, and advance patient-centric treatments. This article explores data analytic strategies that pharmaceutical companies are considering to capitalize on the opportunities of personalized medicine.

Big Data in Personalized Medicine

Pharma has always been a data-driven sector; however, the volume of data available today is unprecedented. According to Eric Schmidt, chairman of Google, we generate as much information in a couple of days as all of mankind has since the dawn of recorded history up to 2003 (4). This notion certainly applies to the life-sciences industry, which has seen an explosion of documented patient data over the past decade. This has been spurred by dramatic changes that include advancements in genome sequencing technologies; the adoption of electronic health records (EHRs) across health systems; the sharing of clinical-trial data; and the rise in patient registries, social media networks, and medical and nonmedical device data systems (e.g., smartphones and fitness monitors). These changes have created a virtual explosion of genomic, clinical trials, claims, EHR, and research study data. When paired with the adoption of advanced analytic tools to generate insights from these data, manufacturers are positioned to create more targeted therapies and to transform the way that biopharmaceutical drugs are discovered, developed, and marketed.

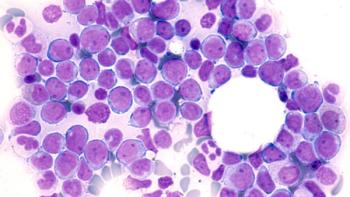

Personalized medicine is rooted in the hypothesis that diseases are heterogeneous in their causes, rates of progression, and their response to drugs. Simply put, each person’s disease is potentially unique, and therefore, that person needs to be treated as an individual. Thus, the shift toward personalized medicine has required that manufacturers develop rigorous strategies to understand the cause or origin of a disease as opposed to simply treating patients’ symptoms. Ted Driscoll, digital health director at Claremont Creek Ventures, believes that mining data on genomics, proteomics, and metabolomics alongside clinical-trial data and real-world clinical data will enable manufacturers to more thoroughly understand the particular structure of a disease. This understanding will lead to faster and more accurate identification and validation of targets and biomarkers for designing personalized therapies (5). Some forward-thinking manufacturers are already participating in public-private research initiatives to harness the power of “big data” and genome sequencing to improve the success rate for discovering new personalized medicines (Table I). Such strategies will enable manufacturers to implement patient-centered approaches across all stages of translational and clinical research in therapeutic areas where targeted therapies are lacking.

Traditional clinical trials enroll a tightly selected group of patients to show, under highly controlled circumstances, that a drug’s effects are statistically significant. As manufacturers invest greater resources in drug discovery focused on the etiology and mechanism of specific diseases, diagnostic biomarkers will help target a patient population that will optimally respond to therapy. Clinical trials designed to test these personalized medicines will likely become more structured as well. Using personal medical and population genomics data, manufacturers now have tools to design more targeted clinical trials by matching cell types and individual metabolic response to the drug candidate, recruiting subjects who will be more likely to respond and excluding those likely to have treatment-limiting side effects.

Some global manufacturers have already launched personalized medicine clinical trial strategies that could change how drugs are studied and potentially cut the time and cost of bringing them to market (see Table II). Multi-drug, multi-arm, biomarker-driven clinical trials are one strategy manufacturers are putting into practice. According to Maria Freire, PhD, president and executive director of the Foundation for the National Institutes of Health, this clinical trial design establishes a model of clinical testing that more efficiently meets the needs of both patients and drug developers. “This strategy will validate biomarkers and facilitate drug development in one infrastructure, to more rapidly provide safer and more effective treatments to patients” (6).

Table II: Examples of more personalized clinical trial strategies.

Finally, as greater volumes of patient reporting information are captured and tracked, manufacturers should be reviewing that data and correlating the real-world reactions of patients with their clinical data to ensure that the intended outcome of the drug or device is actually happening. This especially holds true for manufacturers of companion diagnostic tests as it is often more difficult for these developers to achieve broad coverage and value-based reimbursement for their product. To this point, some manufacturers have already created proprietary data networks through partnerships to gather, analyze, share, and respond to real-world outcomes and claims data. One example involves Genomic Health’s Oncotype DX for breast cancer recurrence, where the manufacturer analyzed the real-world outcomes and costs of 925 Humana patients managed with diagnostic and demonstrated significant cost savings (7).

Moving Forward

The volume of health-related data is exploding at an unprecedented rate. While having access to these data is important, access alone does not advance the science. The real challenge that manufacturers must address is asking the right questions and effectively discerning which data are of value in answering these questions. Given the sheer volume of information available, framing appropriate questions along with data and analytic capabilities will be key differentiators in personalized medicine. Some organizations may be able to do these analytics in-house, while others may need to consider investing in data through innovative partnerships with healthcare-focused and even non-healthcare focused entities. Regardless, manufacturers at the leading edge of personalized medicine will be those that invest resources to determine where true medical unmet needs exist and what data and analytics can answer key questions around improving patient outcomes.

From a drug discovery and development standpoint, the ability to manage, integrate, and link data across functions (e.g., safety, clinical studies, regulatory, patient reported outcomes, etc.) will enable manufacturers to conduct comprehensive data mining that can facilitate lead generation as well as identify related applications or potential safety issues. In order for this to be possible, however, silos that have historically separated internal functions will need to be removed to allow for end-to-end data integration. R&D heads can also use genomic data, clinical-trial data, and real-world data to prioritize investments in specific disease areas. Criteria such as potential clinical relevance of biomarkers and feasibility of discovering biomarkers should also be considered given the increasing importance of biomarkers and companion diagnostics in personalized medicine.

As manufacturers continue to develop more targeted therapies, clinical trials must be more targeted as well. Essentially, clinical trials must be designed so that they can show, early on, if a drug is efficacious for the first cohort of patients. Manufacturers must identify appropriate patients using more data sources (e.g., patient registries and social media) and additional criteria (e.g., genetic composition). Targeting specific populations will allow for trials that are smaller, shorter, less expensive, and more powerful. When appropriate, manufacturers that develop or invest in companion diagnostic tests early on in their R&D processes will be better-positioned to conduct such studies.

With payers increasingly driving value-based reimbursement strategies for services, therapeutics, and devices, the availability of data around individual patients’ medical history, clinical interventions including prescription history, outcomes, and cost will help drug manufacturers develop better target therapies and stratify populations thereby optimizing value and patient outcomes.

References

1. Decision Resources, What You Need to Know to Create or Sustain a Personalized Medicine Strategy for Your Company (2013).

2. FDA, Paving the Way for Personalized Medicine: FDA’s Role in the New Era of Medical Product Development (October 2013).

3. A. McConaghie, “Can big data really transform healthcare?” 2014

4. M. Kirkpatrick, Google CEO Schmidt: “People Aren’t Ready for the Technology Revolution”

5. J. Rowe, Top 5 Pathways to Personalized Medicine,

6. National Cancer Institute,

7. K. Pothier and G. Gustavsen, Personalized Medicine, 10(4) 387-396 (2013).

About the Authors

Jill E. Sackman, DVM, PhD, is a senior consultant, and Michael Kuchenreuther, PhD, is a research analyst, both at Numerof & Associates, Inc., St. Louis, MO,

Articles in this issue

over 11 years ago

Ross Agitated Vessel Includes Silicone Heating Blanketsover 11 years ago

Biopharma Manufacturers Respond to Ebola Crisisover 11 years ago

Determining Facility Mold Infectionover 11 years ago

Romaco Kilian's Tablet Press Introduces Continuous Weight Controlover 11 years ago

GEA Pharma Systems Valves Contain Powdersover 11 years ago

Packaging Addresses Cold-Chain Requirementsover 11 years ago

Fluorination Remains Key Challenge in API Synthesisover 11 years ago

Fette Tablet Press Designed for High Productionover 11 years ago

Bolstering Graduate Education and Research ProgramsNewsletter

Get the essential updates shaping the future of pharma manufacturing and compliance—subscribe today to Pharmaceutical Technology and never miss a breakthrough.