Ireland: The Gateway to Biopharma's Future

Despite recent changes in corporate tax law, Ireland remains a valuable and attractive partner in the development and manufacture of biopharmaceuticals.

The biopharmaceutical industry has been on somewhat of a hot streak in recent years with an increase in the approval rates for new drugs. High-growth biopharma companies have been looking to expand overseas and Europe remains particularly attractive. A mature healthcare workforce of more than 500,000 is hard to ignore. In the past five years, many biopharma companies have found that Ireland is an ideal candidate to drive its European growth.

Forbes

Ireland’s Rise to Prominence

All of these companies made a conscious effort to establish operations in Ireland for several sound strategic reasons. They observed the success that more established pharma companies such as Pfizer, Johnson & Johnson, Lilly, and Merck have enjoyed in Ireland over many years. Biopharma companies produce valuable assets with great clinical and fiduciary value, but when an asset matures, companies need to develop a sound strategy to preserve the value of that approved drug. Ireland’s track record is excellent in terms of the successful commercialization of high-value assets, from Pfizer’s Lipitor (atorvastatin) to Lilly’s Zyprexa (olanzapine). Ireland is well versed in manufacturing, supply-chain management, and building R&D facilities in Ireland.

Ireland has changed its corporate residency rules in line with international developments. This change, mandated by The Irish Department of Finance, will require that all new companies incorporated in Ireland will also be tax resident in Ireland starting Jan. 1, 2015. For companies with existing operations in Ireland, a transition period to 2020 will be provided. Despite this change, Ireland’s low corporation tax, talented workforce, and regulatory track record have proven attractive for enterprises in the United States over many years.

No Language Barriers

Switzerland, Germany, Singapore, France, and the United Kingdom all compete directly with Ireland when it comes to globalizing the next big thing in biopharma. Enterprises are finding that developing international markets from a new country creates difficulties and uncertainties. Globalizing via a country that speaks the same language can reduce unnecessary stress on a business. Ireland not only boasts a large English-speaking workforce, but also has multilingual talent coming in from other European countries, creating a cosmopolitan international workforce. Looking beyond language, Ireland has strong cultural touch points for American companies. A young, flexible workforce with an entrepreneurial spirit, combined with a deep managerial talent pool experienced in working in US corporations, is attractive to investors venturing across the Atlantic for the first time.

Higher Education Presents More Opportunities

According to the EU Labour Force Survey Report by Eurostat, Ireland holds the top spot in Europe for third-level education completion. The pharmaceutical industry has thrived in Ireland with academic degrees particularly suited to the sector. In addition to the universities, the government has invested more than $80 million in the construction of a state-of-the-art training and research facility for the growing biotechnology sector. The National Institute for Bioprocessing Research and Testing (NIBRT) acts as a “flight simulator” for biotech, providing graduates with real-world hands-on training in biotech manufacturing and research to support rapid and successful onboarding in the biopharma industry. NIBRT made its impact immediately by winning the 2012 BioProcess International award for Manufacturing Collaboration of the Decade. This is another way in which Ireland can help “de-risk” investment for the biopharma industry—by ensuring the workforce has the education and practical training to support the commercialization of the company’s assets.

Irish Workforce

The research outputs and revenue of biopharma companies globally have been increasing in recent years, and market capitalizations have reflected this growth. The workforce of the growing biopharma cluster in Ireland demonstrates a healthy appetite for innovation that resulted in Ireland placing third for labor productivity globally, according to the 2014 IMD World Competitiveness Report. The Irish workforce has an average age of 35 (one of the youngest in the world). This productivity partly stems from talent coming out of Irish academic institutions, including graduates ripe with hands-on research and biopharma field experience. The other part of the workforce is a result of the fast-paced, competitive business environment in Ireland. Ireland has essentially created a hyper-competitive environment with much to offer recent graduates.

The life-science industry has already created jobs for 50,000 people in Ireland, across pharma, biopharma, and medical technology. Allergan will be creating 200 jobs to manufacture Botox (botulinum toxin type A). On Oct. 2, 2014, West Pharmaceutical Services added 150 jobs for its newest manufacturing plant.

Building the R&D Community

Ireland has significantly increased support for R&D in the past 10 years, through a combination of funding for in-house R&D by companies, support for academic research groups, and incentives for collaboration. The attraction of a 25% R&D tax credit in Ireland has captured the attention of many biopharma companies. This R&D tax credit covers R&D activity conducted in-house (both process and product R&D). Most biopharma companies in Ireland have taken advantage of this tax credit as they add process R&D to their manufacturing mandate as a result.

BioMarin will now host two different operations running out of Dublin and Cork, focusing on manufacturing, process R&D, and commercial functions. The expansion, which will create 200 jobs by 2017, gives BioMarin the ability to focus on the successful launch of Vimizim (elosulfase alfa), an enzyme replacement drug to treat a lysosomal storage disorder.

The Future of Biopharmaceuticals

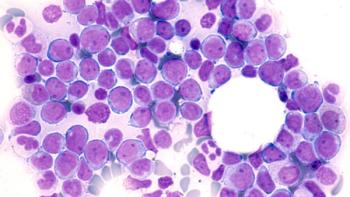

Following some lean years in the pharmaceutical industry (when the industry faced the challenges associated with patent expirations, low R&D productivity, and reimbursement issues), specialized biopharma companies like Gilead, Jazz, Alexion, Regeneron, and BioMarin have managed to chart strong revenue growth and build exciting pipelines. The industry as a whole is now following the biopharma industry’s lead. Long-established companies like Pfizer and BMS are increasingly focusing on biotechnology and seek to develop blockbuster drugs for stratified patient populations. Certain therapeutic areas, such as oncology, have benefitted from this change in industry modus operandi.

Compelling data on new drug candidates in the treatment of cancer are emerging all the time, and other disease areas are seeing similar breakthroughs. A common theme in this new world order is that Ireland remains extremely attractive to these companies and represents a great place to grow and maintain a company’s momentum in innovation.

Rory Mullen is the West Coast director and senior vice president of IDA Ireland. For more information, email

Newsletter

Get the essential updates shaping the future of pharma manufacturing and compliance—subscribe today to Pharmaceutical Technology and never miss a breakthrough.