- Pharmaceutical Technology, June 2022

- Volume 46

- Issue 6

- Pages: 47-48

Big Pharma in the Balance

Is AI a panacea for pharma’s productivity gap?

Artificial intelligence (AI) is a disruptive force and promises to help speed up drug identification; improve patient selection; create digital twins; improve manufacturing; tailor marketing material; enhance customer engagement; predict chronic diseases; and support health equity (1). However, there are some disadvantages with AI that need to be taken into consideration.

The following article discusses AI in the bio/pharmaceutical industry and its effect on who, what, when, and why its adoption is of interest.

Who: winners and losers

- In 2021, AI start-ups attracted $66.8 billion in investment (+108% year-on-year) and healthcare AI accounted for nearly 20% of total funding (2). Healthcare AI company Deep Mind (a Google Health company) was in pole position followed by IBM Watson Health and Oncora Medical. However, many companies such as Babylon Health and Caption Health are waiting to jump on the podium (3).

- Investment in AI has stimulated growth in start-ups, specialized products, initial public offering (IPOs), and acquisitions. Exscientia, one of the first companies to evaluate AI-designed drugs in Phase I clinical trials listed on the NASDAQ with a valuation of US$3 billion in October 2021 (4). In December 2021, Benevolent AI signed an agreement with the SPAC, Odyssey Acquisition to accelerate its AI-enabled clinical pipeline and reached unicorn status with a pre-money valuation of €1.1 billion (US$1.24 billion) and a post-valuation of up to €1.5 billion (US$1.69 billion) (5).

- Not surprisingly, AI start-ups have attracted a lot of attention from biopharma with Pfizer, Takeda, and AstraZeneca leading the way in terms of deals, followed by Novartis, Bristol Myers Squibb (BMS), Roche, Janssen, Merck KGaA, Boehringer Ingelheim, Bayer, GlaxoSmithKline (GSK), and Sanofi (6). A number of partnerships have already been announced in 2022 between AstraZeneca/Benevolent AI (7), Sanofi/Exscientia (8), Shinogi/Elix (9), Shinogi/NEC Corporation (10), Astrogen (11), Ono Pharmaceutical (12), and Teijin Pharma with Iktos (13).

- However, all is not rosy in the AI garden. Concerns have been raised regarding the accuracy of AI-supported software used to diagnose and guide treatment (14, 15), highlighting the importance of high-quality training data to prevent AI bias and, in some cases, AI-enabled systems may be more beneficial to augment human decisions rather than as standalone tools (14, 16). In addition, the ethical implications of using AI analytics and the wider issues associated with healthcare data storage and data security continues to be debated, emphasizing the need for strict regulatory oversight in this area (17).

What: leading innovators

- Although many biopharma companies have established their own in-house AI capabilities, some still rely on partnerships with AI vendors—Atomwise, BenevolentAI, ConcertAI, Exscientia, Google Quantum AI, Iktos, Insilico Medicine, MicroSoft, Recursion Pharma, and Sensyne Health—to support their drug discovery programs and identify novel drug targets, biomarkers, and new chemical entities for clinical valuation (18, 19).

When: new arrivals

- According to market research (2021), the global AI in pharma market is expected to grow from US$935 million in 2021 to US$1236 million in 2022 at a compound annual growth rate of 32.3% driven by the launch of new start-ups and new services (20). Pharma is looking at leveraging AI beyond drug discovery and development to transform the way they perform clinical trials and interact and communicate with stakeholders. This has fuelled a new breed of AI start-ups—AiCure, Avaya, Deep Lens, Owkin, UNlearn.AI, and VeriSIM Life—to service this need (21, 22).

Why: pluses and minuses

- Overall, AI is being adopted on a large scale by pharma and healthcare companies due to its capacity to bring intelligence to repetitive tasks. It is well-suited to managing substantial amounts of healthcare data and can be deployed quickly, cheaply, and flexibly across the supply chain to problem-solve and tailor solutions to meet business requirements and market demands. For instance, in a review article Paul Debleena et al. (2021) stated, “AI can also be implemented for the regulation of in-line manufacturing processes to achieve the desired standard of the product. Artificial Neural Network (ANN) based monitoring of the freeze-drying process is used, which applies a combination of self-adaptive evolution along with local search and backpropagation algorithms. This can be used to predict the temperature and desiccated-cake thickness at a future time point (t + Δt) for a particular set of operating conditions, eventually helping to keep a check on the final product quality” (23).

- Nevertheless, an AI-driven approach requires a different business mind-set and culture, one where management must buy-in to AI-generated insights to drive the decision-making process. AI relies on leveraging historical data to train the algorithms, so the adage ‘junk in, junk out’ is very apt and the use of high-quality data alongside robust governance processes and human oversight will be essential to instil trust and increase accountability. The buck stops with humans/the CEO and not machine.

Food for thought

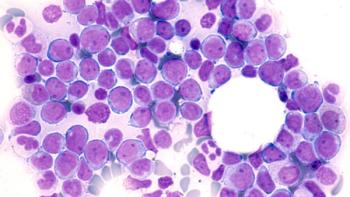

Many experts argue that if pharma does not invest in AI it will fall behind because a rule-based AI model can help analyze large quantities of data to support decision-making, drive efficiencies, and increase profitability. Aran Maree, chief medical officer, The Janssen Pharmaceutical Companies (J&J) posted on LinkedIn that, “Single cell datasets are transforming the field of drug discovery. By leveraging AI and Machine learning, we’re able to analyse individual cells, identify specific genes involved in disease progression—and then identify potential ways to better treat these diseases … my company announced that we are joining a new pre-competitive consortium, led by Rancho BioSciences, that will help us leverage the power of single cell datasets to drive the discovery and development of innovative medicines. The mission of the consortium is to find a common industry standard around how single cell datasets are created and formatted. This is an exciting example of how we can use the power of data science to advance precision medicine and shape the future of healthcare to benefit patients everywhere” (24). Expect to see and hear more partnership announcements as the bio/pharmaceutical industry feels its way forward.

References

1. L. Kwo, “Contributed: Top 10 Use Cases for AI in Healthcare,” MobiHealthNews.com, July 1, 2021.

2. CB Insights, State of AI Global 2021, 2021.

3. QWay Healthcare, “Top Trends in AI in Healthcare for 2022,” QSY Healthcare.com, blog post, 2022.

4. iMedia, “AI Pharmaceutical Industry Welcomes IPO Again, with a Market Value of Over US$3 Billion,” min.news, May 21, 2022.

5. BenevolentAI, “Benevolent AI and Odyssey Acquisition Business Combination,” Press Release, Dec. 6, 2021.

6. Global Data Healthcare, “Big Pharma Forging More Partnerships with AI Vendors for Drug Discovery, ClinicalTrialsArena.com, Jan. 22, 2021.

7. Benevolent AI “BenevolentAI Announces 3-Year Collaboration Expansion with AstraZeneca Focused on Systemic Lupus Erythematosus and Heart Failure,” Press Release, Jan. 13, 2022.

8. Exscientia, “Exscientia and Sanofi Establish Strategic Research Collaboration to Develop AI-driven Pipeline of Precision-Engineered Medicines,” Press Release Jan. 7, 2022.

9. Elix, “Elix, Inc. Begins Collaboration With Shionogi & Co., Ltd. on Elix Synthesize (AI Drug Discovery Module) for Verification of Practical Retrosynthetic Analysis,” Mar. 25, 2022.

10. Shionogi, “Shionogi and NEC collaborate on hep B vaccine development,” Press Release, Apr. 18, 2022.

11. Iktos, “Collaboration with Astrogen to Use AI Platform,” Press Release, Jan. 5, 2022.

12. Iktos, “Collaboration With Ono in Artificial Intelligence for New Drug Design,” Press Release, Mar. 30, 2022.

13. Iktos, “Iktos and Teijin Pharma to Co-Develop New Technology for Small Molecule Drug Discovery,” Press Release, Apr. 5, 2022.

14. S.L. van Winkel, et al., Eur Radiol, 31, 8682–8691 (2021).

15. University of Cambridge, V. Antun, et al., On Instabilities of Deep Learning in Image Reconstruction and the Potential Costs of AI, PNAS 117 (48) 30088-30095, May 11, 2020.

16. ByteBridge, “Why the High-Quality Training Data is so Important to AI Machine Learning?” Becoming Human: Artificial Intelligence Magazine, May 24, 2021.

17. Lexalytics, AI in Healthcare: Data Privacy and Ethics Concerns, Feb. 10, 2021.

18. M. Ayers, et al., “Adopting AI in Drug Discovery,” BCG, March 29, 2022.

19. K.K. Mak, M.K. Balijepalli, M.R. Pichika, Expert Opin Drug Discov., 2022 Jan;17(1):79-92.

20. The Business Research Company,

AI In Pharma Global Market Report, March 2022.

21. K. Parkins, “Five AI-enhanced Clinical Trial Start-ups to Watch in 2021,” Clinical Trials Arena, July 29, 2021.

22. IDEA Institute on Artificial Intelligence, AI Communication Facilitation between Stakeholders, July 15, 2021.

23. D. Paul, et al., Drug Discovery Today, 26(1), 80–93 (2021).

24. A. Maree,

About the authors

Cleo Bern Hartley is a pharma consultant, former pharma analyst, and research scientist.

Article details

Pharmaceutical Technology

Vol. 46, No. 6

June 2022

Pages: 47-48

Citation

When referring to this article, please cite it as C.B. Hartley, “Big Pharma in the Balance,” Pharmaceutical Technology 46 (6) 2022.

Articles in this issue

over 3 years ago

Automating Aseptic Processing Reduces Contamination Riskover 3 years ago

Focusing on the Patient in Drug Developmentover 3 years ago

Development of Coprocessed Excipientsover 3 years ago

Early Development Challenges in IND Applicationsover 3 years ago

Ensuring Patient Safety Through Elemental Impurity Analysisover 3 years ago

When Is It Appropriate to Outsource Bioanalysis Work to a CRO?over 3 years ago

Considerations for Cleaning Lipid Nanoparticlesover 3 years ago

Connecting the Dots for Pharmaover 3 years ago

Enhanced Role of EMA in EU Crisis ResponseNewsletter

Get the essential updates shaping the future of pharma manufacturing and compliance—subscribe today to Pharmaceutical Technology and never miss a breakthrough.